Advertisement

Are you looking for a safe and secure way to invest your money? Are you interested in finding the best bank CD rates available?

CDs are one of the most popular investment options among consumers because they guarantee a fixed rate of return, no matter what's happening with other investments.

In this blog post, we'll cover the basics of bank CDs and guide where to find competitive CD rates. With this information, you can make an informed decision about where to invest your hard-earned money. Keep reading to learn more!

A Certificate of Deposit (CD) is a time deposit held at a bank. It’s similar to a savings account but with one key difference: instead of earning a variable interest rate over time, you earn a fixed rate that stays the same throughout the life of your CD.

This makes CDs attractive because the amount of money you receive when it matures is predetermined.

By investing in a CD, you can lock in your savings rate for up to five years without worrying about market fluctuations or inflation affecting your return.

Your money remains secure and accessible during the life of the CD, and it’s FDIC-insured against loss.

When you invest in a bank CD, you'll earn interest on the money you've deposited over the investment term. The amount of interest can vary based on several factors, including your deposit amount, the length of your investment, and the current market rates.

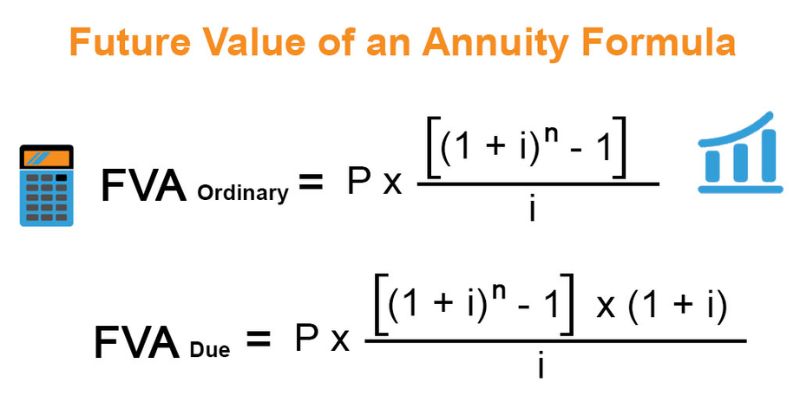

It's important to understand compound interest when considering CD investments. Compound interest is calculated by adding all the interest earned to your initial deposit and then using that higher amount to calculate the next period's interest.

This means you'll earn more as time goes on because your investment grows in value with each compounding period.

Once you understand interest, you can look for the best CD rates. You'll want to compare different banks and investments to ensure you get the most competitive rate.

There are a few places to look for the latest CD rates, such as online financial resource websites, newspapers, and magazines.

Additionally, many banks offer CDs with specific terms and interest rates, so it pays to shop around. When comparing options, check fees and any other restrictions that may apply before making your final decision.

Bank CDs provide an excellent opportunity for people looking for a safe and secure way to invest their money. With proper planning and research into the current market conditions, you can ensure you get the best CD rates for your investment.

Additionally, understanding compound interest can help you maximize your return over time as your money grows and compounds with each period.

With the right research and financial planning, bank CDs can be a great way to save and grow your money.

When investing your money, it's important to understand your options and choose the CD rate that best fits your financial goals. Here are some key factors to consider when selecting a bank CD rate:

1. Maturity Date: The maturity date is the length of time for which you'll be committing funds in a bank CD. This can range from six months to five years or more.

Generally, longer-term CDs come with higher interest rates but keep in mind that locking in funds for longer periods may not fit into your investment strategy. Selecting a maturity date that makes sense for your financial goals is important.

2. Interest Rate: The interest rate is one of the most important factors when selecting a bank CD. G

Generally, the longer the maturity date, the higher the interest rate. It's important to compare different banks and CD rates to ensure you're getting a competitive return on your investment.

3. Minimum Deposit: Most banks have a minimum deposit requirement for their CDs. This can vary significantly depending on the institution, so read all the fine print before committing funds.

4. Early Withdrawal Penalties: Before investing in a bank CD, it's important to understand any early withdrawal penalties that may apply. Some institutions may charge substantial fees if you need access to your money before the end of the term period.

By considering these key factors and researching different rates, you can decide where to invest your money. With the right bank CD rate, you can protect and grow your nest egg, so you'll have more to look forward to.

When investing your money, bank CDs can offer several advantages. Here are some of the benefits that come with opening a CD account:

1. Fixed Rate of Return – With a bank CD, you will be guaranteed a fixed rate of return regardless of market conditions or economic trends. This lets you know exactly your returns over time and plan accordingly.

2. Low-Risk Investment – CDs are considered low risk because they are FDIC-insured up to certain limits. This means you can still get your money back even if the bank fails.

3. Flexible Options – Various CD terms range from short-term CDs with 3–6 month maturities to long-term CDs with 10+ year maturities. This allows you to choose an option that best fits your needs and risk tolerance.

4. No Fees or Taxes – Bank CDs do not require maintenance fees or minimum deposits, so it is easy to open an account without paying anything out of pocket. Additionally, most bank CDs are tax-deferred, meaning you can wait until maturity to pay taxes on any interest earned.

Once you’ve determined which bank CD rates are best for your investment goals, there are several strategies you can use to maximize your return.

First and foremost, choosing the right type of CD is important. Generally speaking, long-term CDs offer higher interest rates than short-term ones because they involve a longer commitment.

However, opting for a shorter-term CD might be wise if you think you need access to your funds sooner than the CD’s maturity date.

It’s also worth considering laddering CDs. With this strategy, you divide your money into multiple CDs of different terms.

When these investments mature, you can withdraw or roll the funds into another CD. This allows you to benefit from higher CD rates without committing your money for too long.

Finally, you can get a better rate if you open multiple CDs at the same bank. Most banks offer discount rates when customers buy multiple CDs in bulk. Compare rates across different banks before investing to find the best deal.

Interest rates can vary widely between banks and different types of CDs. To find the best CD rates, compare offers from several banks to get the most competitive rate for your investment.

A good CD account rate depends on your financial situation and risk tolerance. Compare offers from multiple banks for the most competitive interest rate available.

When comparing CD rates, look for information about the annual percentage yield (APY) and the term length. Also, consider any early withdrawal penalties associated with the CD before deciding. Comparing offers from multiple banks should help you find the best CD rate.

Bank CDs are a reliable and secure way to invest your money. By understanding how bank CDs work and where to find competitive rates, you can make an informed decision about how to invest your money. With the right information and guidance, you can find the bank CD that best meets your needs. So start investing today!

Advertisement

Go For This

Mortgages / Sep 16, 2025

Technology and Innovation / Nov 10, 2025

Banking / Nov 03, 2025

Banking / Oct 09, 2025

Mortgages / Sep 10, 2025

Investment / Oct 04, 2025

Investment / Oct 22, 2025

Investment / Nov 14, 2025